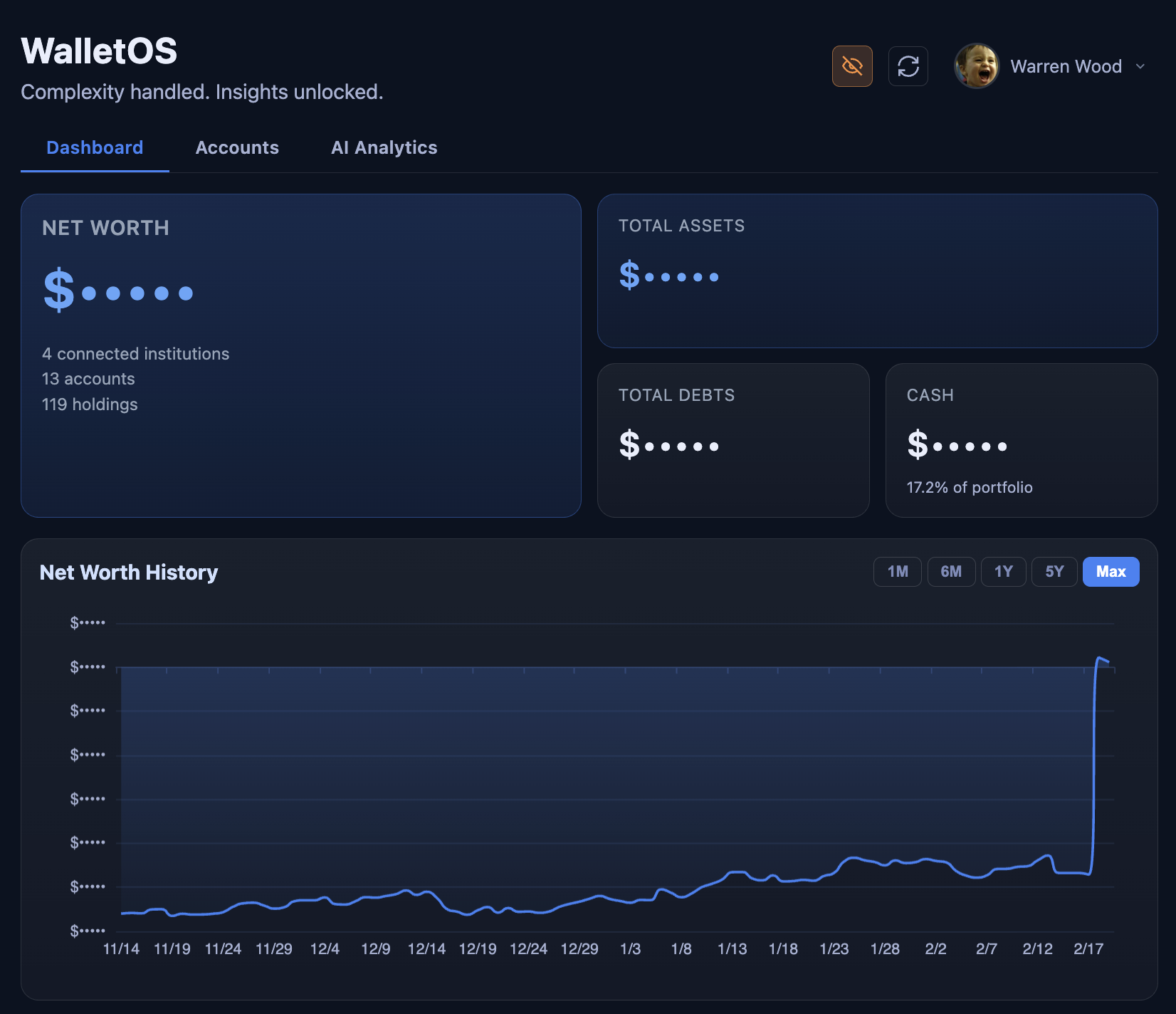

The Portfolio You Can

Talk With

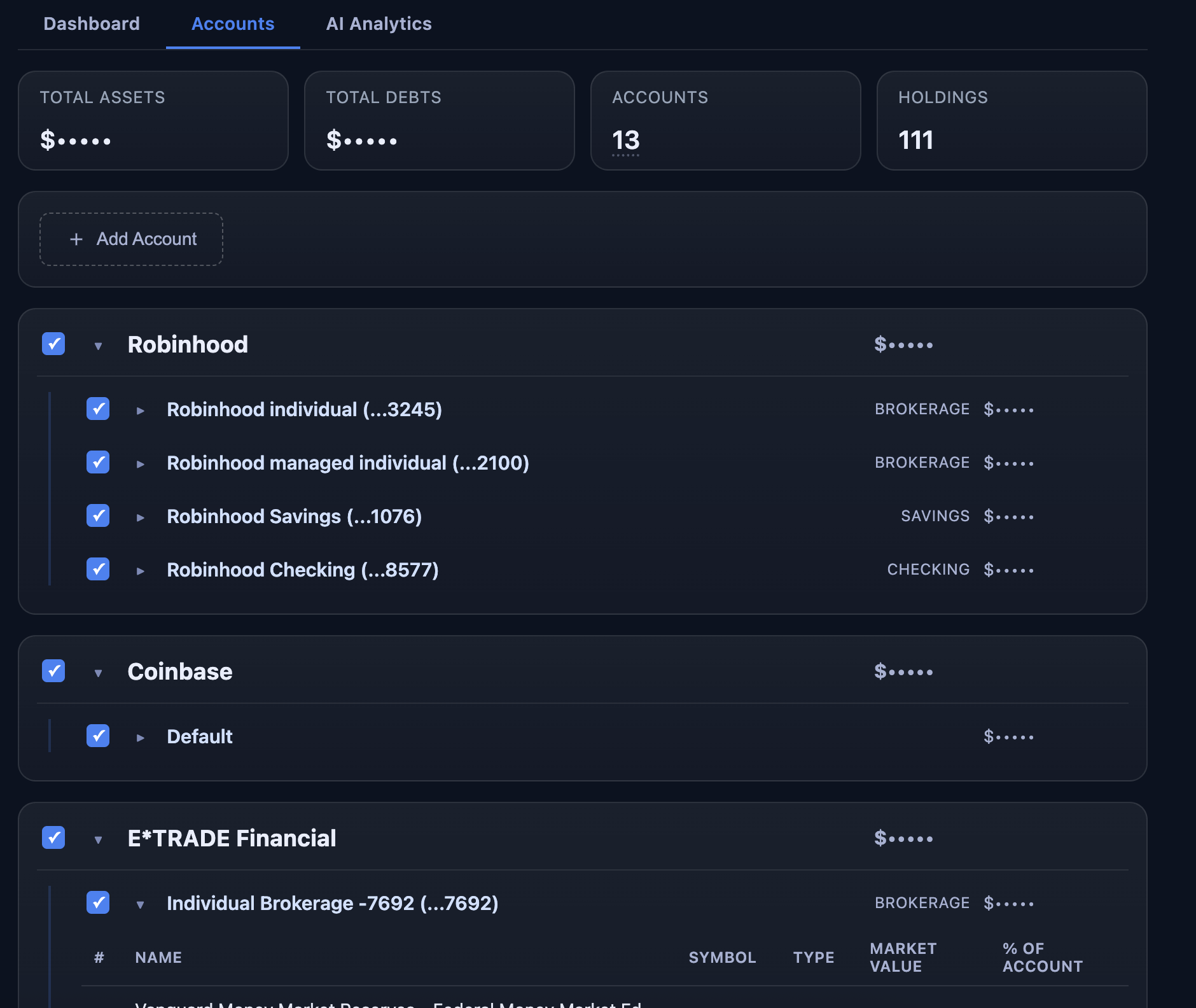

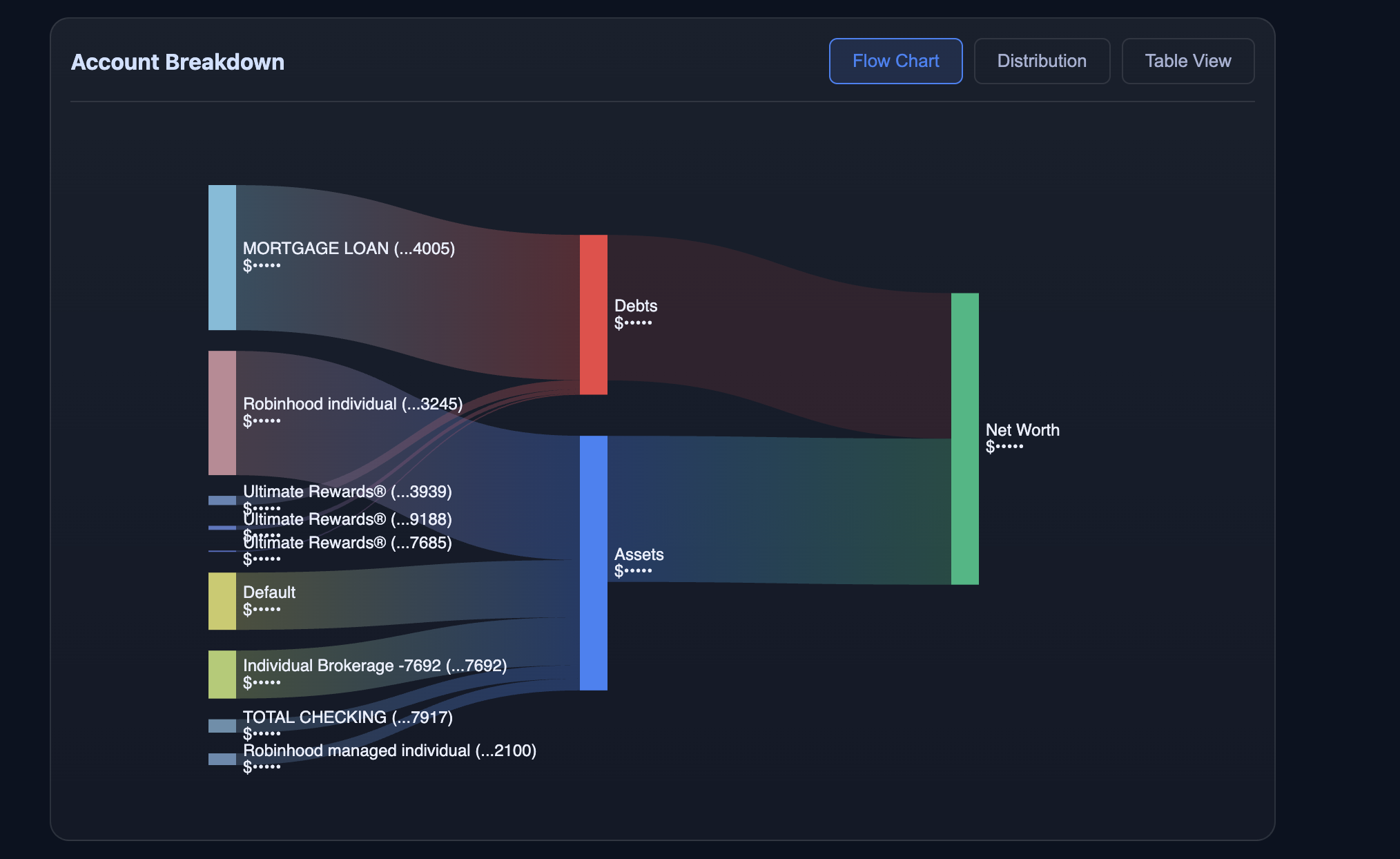

Connect your brokerages and retirement accounts, see everything in one place, and chat with an AI that can explain risk, concentration, and diversification based on your actual positions.

No credit card required. Free tier available.